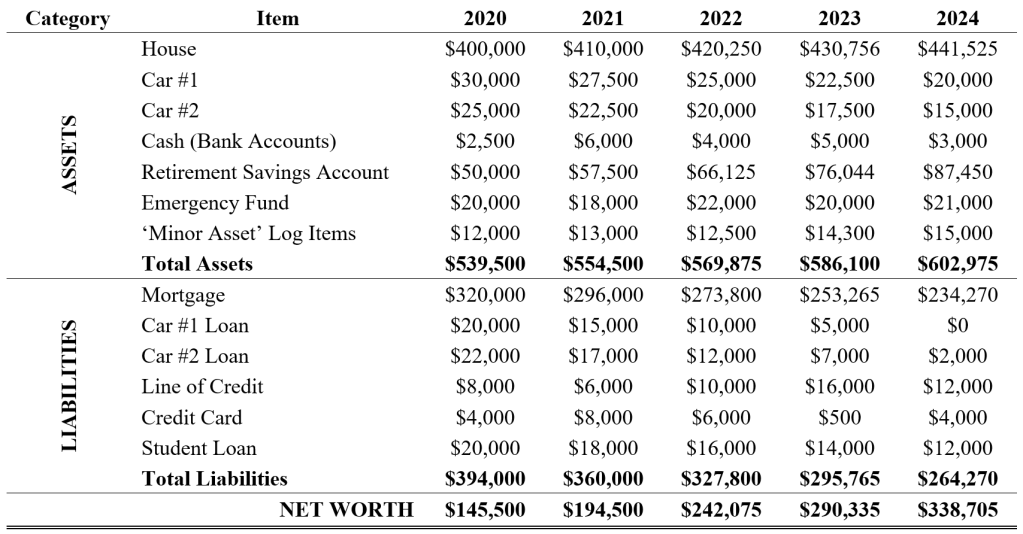

Your Net Worth is an important measure of your financial situation. Net worth is not concerned with your income, your expenses, or your budget – it simply looks at what you own (asset value) and who you owe money to (liabilities). When you subtract the sum of your liabilities from the value of your assets, the result is your net worth. I track my net worth regularly since the value of my assets fluctuates and liabilities as well. Thankfully, since 2020, my liabilities have been zero after aggressively paying off all debts in my twenties. I recommend tracking your net worth at least once per year (end of year is best) so that you can track your progress on increasing your net worth.

The Table below is an example of a Net Worth tracking sheet used for four years. As you can see, asset values increased over time while the sum of the liabilities decreased. Your objectives should align with this – increasing net worth while paying down debt. If you are single or unmarried, your net worth should be calculated individually. If you are married, you should include the assets and liabilities for yourself and your partner (i.e., your household net worth), since you should be working together with your partner to achieve your financial goals. In the Assets category, only list individual items with a value over $2,000; this will keep your table more concise. Items with values between $100 and $2,000, should be listed in the ’Minor Asset’ log items row and tracked on a separate ‘Minor Asset’ Log. All liabilities, no matter how small, should be listed.

Click HERE for an Excel template you can use to track your net worth.

Leave a comment