The Rule of 72 is a simple formula used to estimate how many years it will take an investment to double in value, OR the rate of return required to double the investment value in a known period of time (Kenton, 2025).

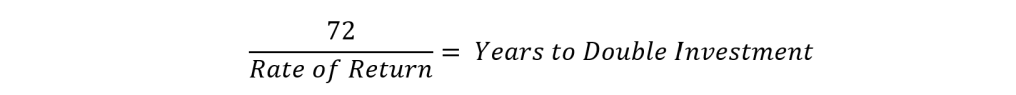

To determine how many years it will take to double your investment, apply the following formula:

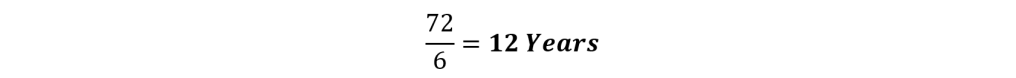

Example: You have an initial investment of $10,000 that you expect to grow at an annual rate of return of 6%. How long will it take to double?

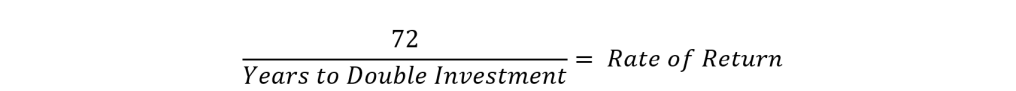

To determine the average rate of return on your investment, apply the following formula:

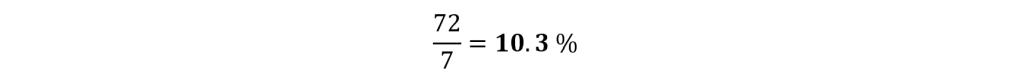

Example: You have an initial investment of $10,000 whose value grew to $20,000 in 7 years. What was the average rate of return?

Another application for the formula can be to estimate the number of years it will take for a debt size to double.

Example: If you have $5,000 in credit card debt at a 24% interest rate, you can estimate that $5,000 will grow to $10,000 in only 3 years (72/24 = 3 years).

Lastly, while we use the constant of 72 for doubling the value of the investment or debt, you can change the constant to 115 for tripling, and 144 for quadrupling.

Example: how long will it take to double, triple, and quadruple my investment based on a rate or return of 8%?

- Double: 9 years (72/8 = 9 years)

- Triple: 14.4 years (115/8 = 14.4 years)

- Quadruple: 18 years (144/8 = 18 years)

References:

Kenton, W. (2025, August 20). The Rule of 72: Definition, Usefulness, and How to Use It. Investopedia. https://www.investopedia.com/terms/r/ruleof72.asp

Leave a comment