Everyone should know their ‘Monthly Minimum’ – this is the minimum amount of money it takes for you to live your life. The amount should include all the expenses you incur simply to survive. It should include expenses like rent/mortgage, utilities, groceries, fuel for automobiles, property tax, insurance, health insurance, automobile payment, childcare, debt obligation payments, mobile phone bills, and necessary maintenance for automobiles and primary residence. Your ‘Monthly Minimum’ should not include anything not necessary for your family to get through the month. Examples of expenses that should not be included in your ‘monthly minimum’ include vacations, restaurants, unnecessary retail purchases, gifts, unnecessary subscriptions (e.g., music, video, etc.), pampering (e.g., manicures, facials, etc.), housewares, hobbies, and recreational activities.

Before determining your ‘Monthly Minimum’, you must know your ‘Monthly Average’ – this is the total amount you spend on average every month. The ‘Monthly Average’ will always be higher than the ‘Monthly Minimum’ since it includes frivolous expenses not necessary for you to live your life and that are left out of the ‘Monthly Minimum’ amount.

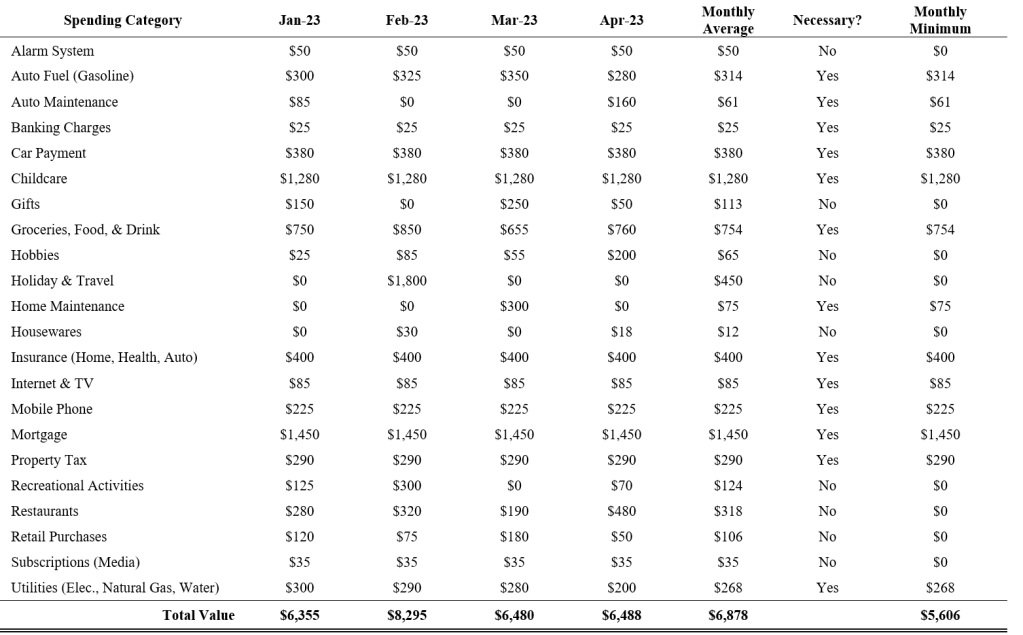

The best way to determine these numbers is to list all your tracked expenses for at least 3 months (ideally 12 months) and take the average of each category. The sum of the category averages is equal to your ‘Monthly Average’. Next, identify which of the categories are necessary and should be included in your ‘Monthly Minimum’ amount. The Table below shows an example of categorizing necessary and unnecessary. In this example, the family’s ‘Monthly Average’ is $6,878 and their ‘Monthly Minimum’ is $5,606.

With this information, you can better understand your financial situation. You may realize that you are currently spending $82,536 per year, but if you cut back the unnecessary items, you could reduce your yearly expenses by over $15,000 to $67,272. Additionally, you can better assess retirement spending requirements or different career prospects. When meeting with a financial advisor about retirement planning, they will ask you – how much will you spend each month? To ensure that you are effectively preparing, you will want to ensure that you are accurate with your estimates. Additionally, when planning and setting financial goals, you will want to use realistic values for your projections which you can easily do once you know your ‘Monthly Minimum’ and your ‘Monthly Average’. A fiscally disciplined person will aim to minimize their unnecessary, which will make their ‘Monthly Minimum’ and ‘Monthly Average’ very close.

Leave a comment