There’s a general understanding that homeownership is better than renting. Similarly, people commonly believe that property values always increase. Furthermore, and as discussed here, some believe that all home renovations can increase their property value more than the cost of the renovation, thus contributing to the amount of home ‘flippers’ looking to buy houses for cheap, renovate them and sell them for a net profit. While there is some truth to all of the aforementioned statements, they are not always certain, and there are many variables. It is true that if you extend the timeline long enough – say 20+ years – homes will have mostly appreciated. Renovations can add value to the home, but the net benefit will vary based on the price paid for the home, and the type and cost of renovation being performed. However, most renovations cost more than the value they add to the home. Other significant contributing factors include the location and type of home, as well as the timing.

Timing

Depending on when you buy and when you decide to sell, you may or may not benefit from appreciation of the home’s value. The London Ontario area, for example, is one of Canada’s hottest real estate markets where property values seldom fall and home prices have more than tripled in the past 25 years (Butler, 2022). When looking at the historical property value charts, it seems like a market where real estate purchases are an investment sure to appreciate. However, depending on the timing of the purchase and sale, home buyers can incur significant losses even in the best of markets. In 2022, a couple purchased a three-bedroom home in London for $730,000 and eleven months later, the value of their home had fallen by $150,000 to $580,000 (Zandbergen, 2023). A loss of $150,000 in equity in less than one year is detrimental to one’s net worth. This is an example to illustrate that homeownership is not always a positive financial decision.

Type of Home

In Edmonton, AB the type of home will greatly affect the appreciation (or depreciation) of its value. In the three years between November 2020 and November 2023, the median sale price for detached homes increased by 7% from $400k to $428k (CREA, 2023). Apartment-style condominiums, however, decreased in value by 25.5% from $208k to $155k. While detached home owners benefitted from value appreciation in recent years, condominium owners lost a quarter of their home value. These values are medians for real estate sales across the entire city. It is important to realize that some neighborhoods may have experienced different changes in property values. Surely, there are some neighborhoods where detached homes lost value in this period, while more desirable neighborhoods may have seen condominium values increase. Generally, though, Edmonton has been a bad market for condominium owners in recent years and many will be selling their homes for less than they paid for them.

Cost of Renting vs. Buying

The cost to purchase a home fluctuates over time, influenced by property values and interest rates, but rental prices are less volatile. Throughout history, there have been periods when renting is cheaper than buying a home, and there are times when buying is cheaper than renting. Currently, as of 2023, thanks to high-interest rates and property values in the US, it is 30% cheaper to rent a house than to buy. The median rental cost in America is $1,850/month while the median cost of homeownership is $2,700 (Venditti, 2023). Simply put, anyone looking to move should consider renting since it will likely be cheaper than buying right now.

There’s a general rule of thumb that states that you should only buy a home if you plan to keep it longer than 5 years. The reason for this is that you want to give the property enough time to appreciate to offset the costs you have incurred from buying and selling it. When buying and selling a home, there are many costs involved. Closing costs include home inspection, appraisal, legal fees, realtor commission, etc. On a $300,000 home, a buyer should expect to pay around $11,500 while a seller should expect to pay around $6,000 in real estate commission (Ramsay Solutions, 2023). You can expect to pay several more thousand dollars on the other costs like legal fees, inspection, appraisal, etc. Additionally, you will be paying property tax, which varies by location, but will likely cost several thousand dollars per year. Another consideration is the forfeited return on investment you would have received by investing the amount used for the down payment rather than using it to purchase the home. For example, if you used $80,000 as a down payment, you could have otherwise invested it (and rented a home instead) and received an annual return of $4,800, assuming a 6% annual rate of return. Once you consider all these costs of homeownership (cost to buy, cost to sell, interest, tax, forfeited investment return, etc.) you will realize that you would need to own the home longer than 5 years to spread those costs out to make the purchase of the home financially cheaper than renting. If you plan to sell in less than 5 years, just rent instead!

My Experience

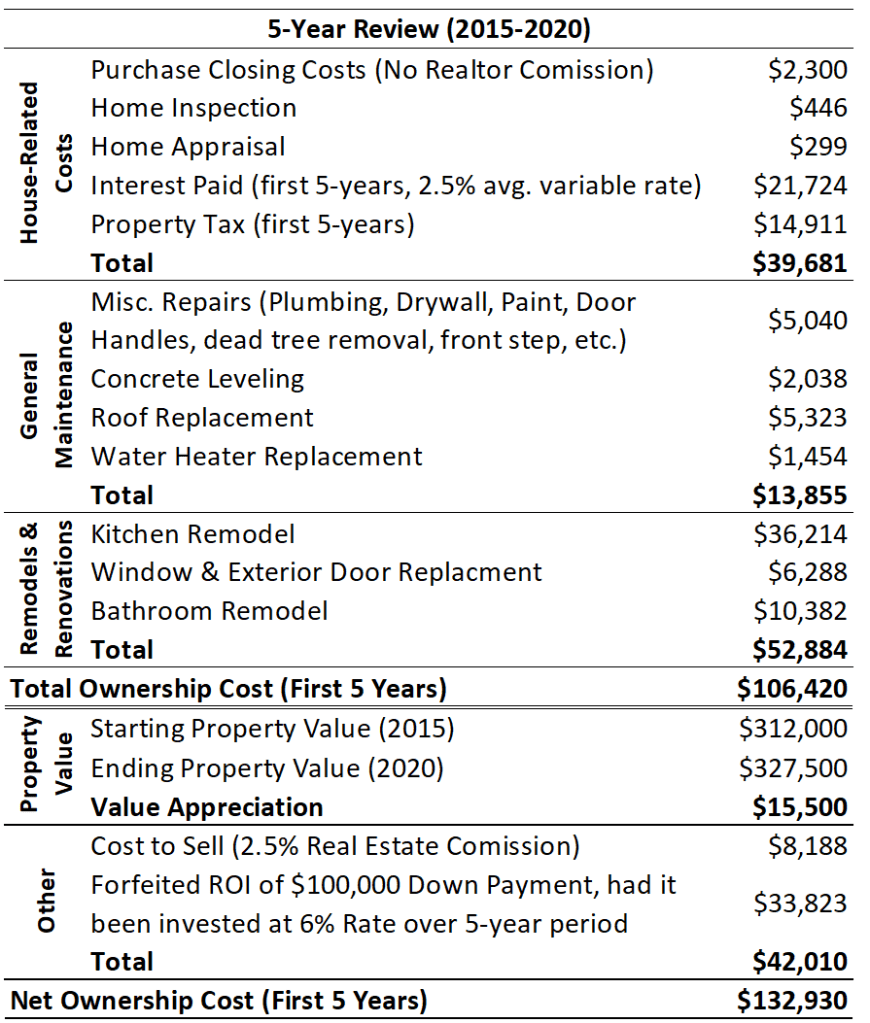

I purchased my first home in 2015; it was $300k and I put down a $100k down payment, leaving a $200k mortgage. The interest rate was 2.5%. It was a fifty-year-old house that needed some maintenance work, and we also decided to do some remodeling. My total costs in the first 5 years were $106k (see table below for full breakdown). Despite having done $14k in maintenance and $53k in renovations, the value of the home only appreciated by $15.5k over the 5 years. If I were to sell the house after 5 years, I would have paid around $8k in realtor commission. The investment return that I could have expected had I invested the $100k down payment (and not purchased a house) is around $34k. When I add up all these costs, I conclude that 5 years of home ownership cost me $132,930, or $2,215/month. Houses similar in size and location in 2015 were renting for $2,000/month. So, between 2015 and 2020, renting the same house would have been cheaper by $215/month or $12,900 over the 5 years.

I learned some valuable lessons as a homeowner. I learned that for every dollar I spent on remodeling the house, the value appreciated by a measly twenty cents (around an 80% loss). I realized that property values do not always increase; two of the five years saw the value of my home decrease. I learned that money spent on general maintenance does not add any value to the home, such as replacing worn shingles, a broken water heater, leveling sunken concrete, lawn care, etc. it is simply expected that homeowners will pay these costs to maintain their home. Finally, I learned that the 5-year rule is accurate and that I would have been better off renting for the first five years (actually six years). However, I have now been in the same house for over eight years, and since my ownership costs are spread out over a longer period, the cost of ownership is now lower than the cost of renting over the same period.

References:

Butler, C. (2022, March 15). London, Ont., region home prices have tripled over the past 25 years | CBC News. CBC. https://www.cbc.ca/news/canada/london/london-ontario-real-estate-1.6384182

CREA. (2023, December 2). Monthly Market Statistics Update Archives. REALTORS® Association of Edmonton. https://realtorsofedmonton.com/stat-type/monthly-market-statistics/

Ramsay Solutions. (2023, September 8). Closing Costs: What Are They and How Much Will You Pay? Ramsey Solutions. https://www.ramseysolutions.com/real-estate/what-are-closing-costs

Venditti, B. (2023, September 1). The Monthly Cost of Buying vs. Renting a House in America. Visual Capitalist. https://www.visualcapitalist.com/buying-vs-renting-house-in-america/

Zandbergen, R. (2023, February 16). Ontario couple who bought their home a year ago now say it’s become a mortgage nightmare | CBC News. CBC. https://www.cbc.ca/news/canada/london/they-bought-their-home-in-march-2022-why-this-ontario-couple-calls-the-purchase-a-nightmare-1.6750229

Leave a comment