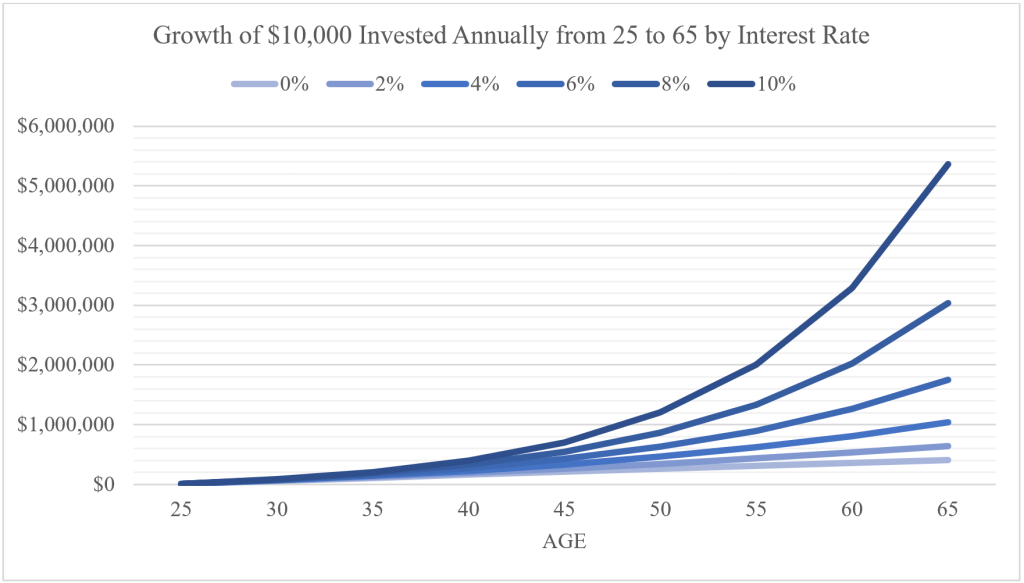

The most important factors influencing the growth of your retirement savings are the interest rate on your investments and the number of years you invest. The following chart illustrates the growth rate of an investment account that has $10,000 deposited into it each year from age 25 to 65. The total amount invested in this period is $410,000, and this would be the account balance at the age of 65 had the funds not been invested (0% interest). However, depending on the interest rate, the account could easily grow into the millions. At a 6% interest rate, the $410,000 investment grows to $1.75 million. And jumping from a 6% to 8% interest rate grows the investment to over $3 million.

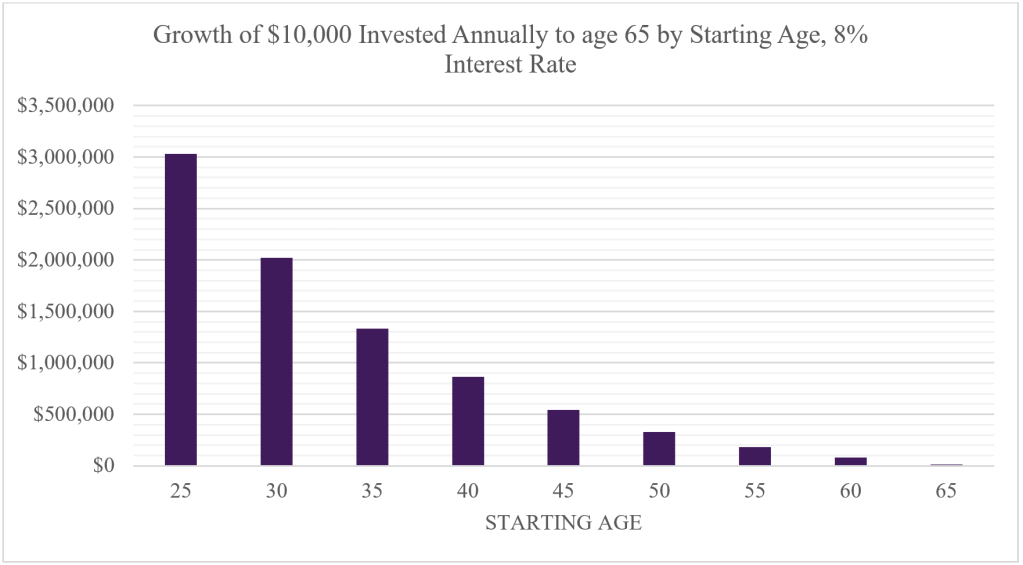

Now that we have grasped the significance that interest rates play on compound growth, let’s discuss the second factor – time. The longer the investment has to compound, the more your money grows. To illustrate this, the following chart represents the investment balance at 65 years old having invested $10,000 per year with an 8% interest rate starting at different ages. By starting at 25, you would have $3 million by age 65. Delaying by only 10 years and starting at 35 – you will have less than half, around $1.3 million. There’s an adage that goes “The best time to plant a tree was twenty years ago. The second best time is now.” This can be used to represent the importance of starting to invest as early as you can in life.

Leave a comment