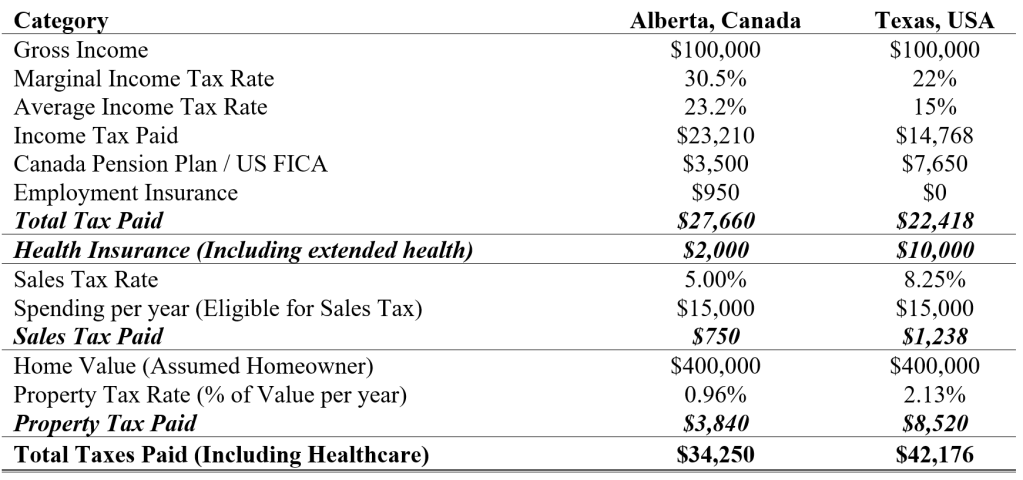

It is important to recognize all of the different taxes you pay. This is critical when considering moving to a new city or country. I was considering a move from Alberta, Canada to Texas, USA a few years ago. Texas to known to have low income taxes since income tax is only payable to the federal government and not to the state. The general understanding among my Texan friends is that Albertans (and Canadians in general) pay much higher than them. When considering the move, I began to list out what all my monthly costs would be in both locations assuming the same gross income. What I realized was that although there is a lower income tax rate, the income taxes in Texas do not include universal healthcare, and the property taxes are more than double the rate that I was paying in Alberta. When factoring in the increased cost of property tax and the additional out-of-pocket cost of health insurance (something included in Canadian taxes), the tax rate in Texas was higher! According to (Bloom, 2017), the average Texan pays nearly $10,000 per year for their healthcare costs, which includes their premiums and deductibles. The average Canadian pays $2,000 per year for their healthcare costs for services not covered by universal healthcare, such as dental, optometry, etc. (Sinclair, n.d.).

The Table below represents an example* of the comparative cost of taxation between Alberta and Texas. Besides the healthcare and property tax, sales tax is higher in Texas, accounting for an additional $488/year. FICA (Federal Insurance Contributions Act) is a payroll deduction similar to Canada’s Pension Plan (CPP) that funds the Social Security and Medicare programs; its payroll deduction is more than twice the cost of Canada’s CPP. So, it is true that Texas has a lower income tax rate than Alberta; however, when you dig deeper, you realize that the income tax savings are outweighed by the higher out-of-pocket cost of healthcare, the federal pension plan, sales tax, and property tax.

References:

Bloom, E. (2017, June 23). Here’s how much the average American spends on health care. CNBC. https://www.cnbc.com/2017/06/23/heres-how-much-the-average-american-spends-on-health-care.html

Sinclair, S. (n.d.). How Much Money Should I Have In Order to Retire in Canada? – Dundas Life. Retrieved September 24, 2023, from https://www.dundaslife.com/blog/cost-of-health-insurance-in-canada

* The information represented above is only for example purposes and the variables are not meant to be precise. Consult a tax professional for an accurate taxation comparison.

Leave a comment