Affordability is an interesting term; what does it mean exactly? Does “affording” something mean that you can pay for it with cash, or does it mean that you should be able to pay for the item twice (as Jay-Z famously said) – or does it mean that you have enough money to pay the minimum payment on the longest possible loan term for the item? It seems that most people have a different opinion of what ‘affordability” means. To make things more confusing, automobile dealerships will often price their vehicles in terms of biweekly or monthly payment amount – enticing customers with offers of “$326 biweekly” rather than telling prospective customers that the car is $50,000. The customer may agree that $326 biweekly is affordable while $50,000 is not.

Here are the guidelines I recommend.

- Net Worth-Based

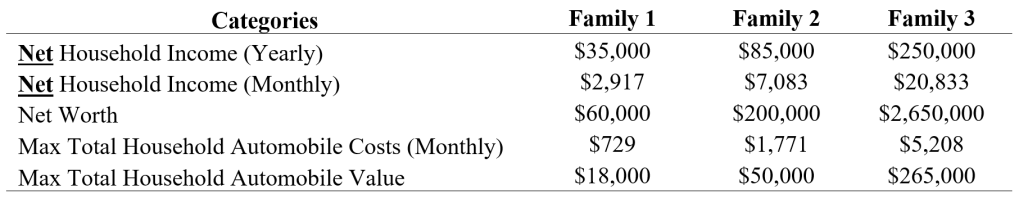

- If your household net worth is <$100,000 – The total value of automobiles in your household should not be more than 30% of your net worth.

- If your household net worth is between $100,000 – $1,000,000 – The total value of automobiles in your household should not be more than 25% of your net worth.

- If your household net worth is > $1,000,000 – The total value of automobiles in your household should not be more than 10% of your net worth.

- Do not purchase a brand-new automobile unless your net worth is > $1,000,000.

- Cost Based

- Your total automobile costs should not exceed 25% of your Net Household Income. This includes loan payments, insurance, maintenance, fuel, and related automotive costs for all automobiles in your household.

These guidelines are applied as examples to the three families below in the Table below. While these guidelines offer maximum values and monthly costs, the goal should always be to minimize costs and ownership of depreciating assets like automobiles so that you can achieve your financial goals more quickly. The exception to the payment-based guidelines above is if you choose to quickly pay down the car loan and temporarily exceed the payment-based guideline. In 2019, I decided to temporarily apply more of my income to quickly pay off my car, which I was able to do without jeopardizing my other financial goals.

Leave a comment