Leasing

Leasing an automobile is akin to a long-term rental. Generally, the car will be leased for a period – say two or four years – during which time monthly payments are made. At the end of the lease term, you will receive the option to either return the vehicle to the leaser or purchase the vehicle at its market price. It is seldom a good financial decision, and leasing a personal car should be avoided (Kamel, 2023). From a simplified perspective, the leaser is a business that intends to make a profit. At the end of the term, the leaser needs to be able to sell the vehicle at market value which means that the lease payments need to cover the cost of depreciation that the car endured during the lease term plus the cost to resell it, plus profit. This means you are generally better off buying a car than leasing. Most will compare the benefits of buying a brand-new vehicle versus leasing a brand-new vehicle. I would argue that unless you have a net-worth above $1,000,000, you should not be looking at brand-new vehicles regardless of if they are leased or purchased – buy used!

Trade-In

There is something everyone should understand about the automobile industry. Dealerships purchase used automobiles at a ‘wholesale’ price and sell them to customers at a marked-up ‘retail’ price. The mark-up pays for the cost to sell and advertise the automobile, and the dealership’s overhead – what’s left is their profit. When you trade in an automobile to a dealership, they will pay you a wholesale value since it will cost them money to prepare it for sale and then sell the vehicle. You may trade-in a car for, say $18,000, and see it advertised for sale at $25,000 the next week. Rather than trading-in vehicles to the dealership, some will sell their cars privately at retail prices through website marketplaces. This is a good way to attain a higher value for your vehicle, however, it can be time-consuming, and you must be careful when dealing with strangers and financial transactions.

Negative Equity

Negative equity is the name of the scenario that occurs when the amount owed on the automobile (or other financed items) is more than what the item is worth (FTC, 2021). Automobiles depreciate quickly, and when financing over a long term, it is common for owners to find themselves in a negative equity situation. In the event that you owe more to the lender than what the car sells for, you will need to pay the lender the difference. As an example, if you purchase a car today for $30,000, and in 6 months, you decide to sell it for $22,000. But you still owe $25,000 to the dealer for the car, so to pay off the loan, you will need to come up with another $3,000 to make up the difference. Some will ‘roll’ negative equity into another automobile loan, which is something to never do!

If we use the same example as above, and the owner of the $30,000 car decides to upgrade to a $40,000 car after 6 months. The dealer offers $22,000 as the trade-in value, but $25,000 is still owed on the loan. In this case, the dealership may offer to ‘roll’ the $3,000 difference into the loan for the $40,000 car, which means that you will have a $43,000 loan for a $40,000 car. You should avoid getting into a negative equity situation. To do so:

- Avoid buying a brand-new vehicle that will depreciate greatly in its first years of ownership.

- Purchase an in-demand vehicle. Avoid buying a unique vehicle that may be difficult to resell.

- Avoid models with poor resale values. Luxury cars generally have some of the highest rates of depreciation. Do some research before purchasing so that you have an idea about the amount of depreciation to expect. There are several websites that will show historical values and estimate future values.

- Take care of your vehicle! Maintain it, wash it regularly, and repair damages when they occur. The condition of the vehicle will impact its resale price.

- If financing, select shorter terms so that the loan is paid down more quickly.

The Zero Percent Interest Rate Trick

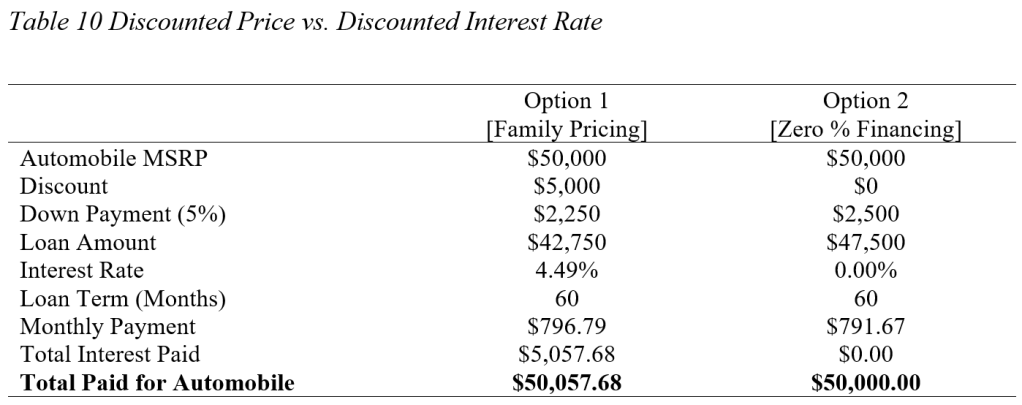

When the car dealership offers a zero percent interest rate, they are not doing it out of kindness. If you pay close attention, you will notice that other incentives will be replaced with low financing rates. For example, in the springtime, a dealer may advertise ‘family pricing’ deals whereby the customer pays a discounted price below the listed MSRP of the car, but it will be at a standard interest rate of say 4.49%. In the summertime, the dealership will remove the ‘family pricing’ discount banners and begin to advertise 0% interest on new cars. The customer will not receive any discount on the total price of the car, but they will pay no interest. Let’s say the dealership can afford to discount up to $5,000 from the MSRP. During the springtime, they will simply discount the car by $5,000 and call it ‘family pricing’. During the summertime, instead of discounting the price, they effectively pay the interest rate down to 0%. The table below breaks down the comparison of a $50,000 car purchased using the same downpayment and same loan term of 60 months with a discounted purchase price (option 1) versus a discounted interest rate. In Option 1, the buyer saves $5,000 off the MSRP but pays $5,057.68 in interest. In Option 2, the customer pays the full MSRP but pays no interest. The important point here is that the car dealers and manufacturers will create varying incentives throughout the year to appeal to different customers, but they all end up spending the same amount! When a salesperson offers you a ‘great deal’ on a new car, always approach the situation with an air of Healthy Cynicism and do your homework!

References:

FTC. (2021, May 6). Auto Trade-Ins and Negative Equity: When You Owe More than Your Car is Worth. Consumer Advice. https://consumer.ftc.gov/articles/auto-trade-ins-and-negative-equity-when-you-owe-more-your-car-worth

Kamel, G. (2023, September 1). How Does Leasing a Car Work? Ramsey Solutions. https://www.ramseysolutions.com/debt/how-does-a-car-lease-work

Leave a comment