Money today is worth more than the same amount in the future. This is because of two things: inflation increases the cost of items over time, and money invested will grow over time. If we consider the effect of just inflation first, let’s assume that yearly inflation is 2%, which means that the same items that cost $100 today, will cost you $102 when you buy them in 1 year. Now, if we consider the lost appreciation of money, we assume that a balanced investment will return 7% per year, $100 invested today will be worth $107 in 1 year. In this example, spending power (inflation) has decreased by 2%, but investments returned 7%, meaning that you beat the rate of inflation by 5% (7%-2%).

If someone were to offer to give you $100 today or $100 one year from now, you would want to take the money now, because a) you can buy more with it today than you will be able to in 1 year, and b) you could invest it, and you will have $107 in one year. To calculate the future value of money we use the Future Value formula which factors in compounding interest.

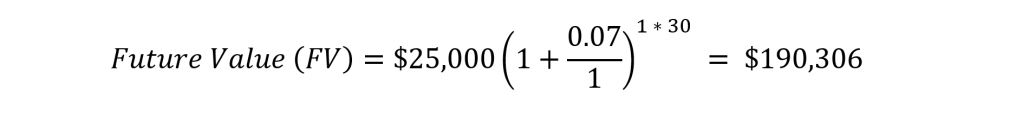

As an example, let’s see what $25,000 invested today will be worth in 30 years when it receives a 7% annual rate of return. By applying the above formula to the scenario (below), we determine that in 30 years, the invested $25,000 will be worth over $190,000.

This concept can be used for many scenarios in practical life; here are some examples:

- If you spend $15,000 instead of $50,000 on a wedding at the age of 25 and invest the difference, you will have an extra $524,106 when you retire at 65 years old.

- If you receive a bonus and spend $12,000 on a family trip to Disney World instead of investing it at the age of 35, you are costing your 70-year-old self $128,119.

Leave a comment