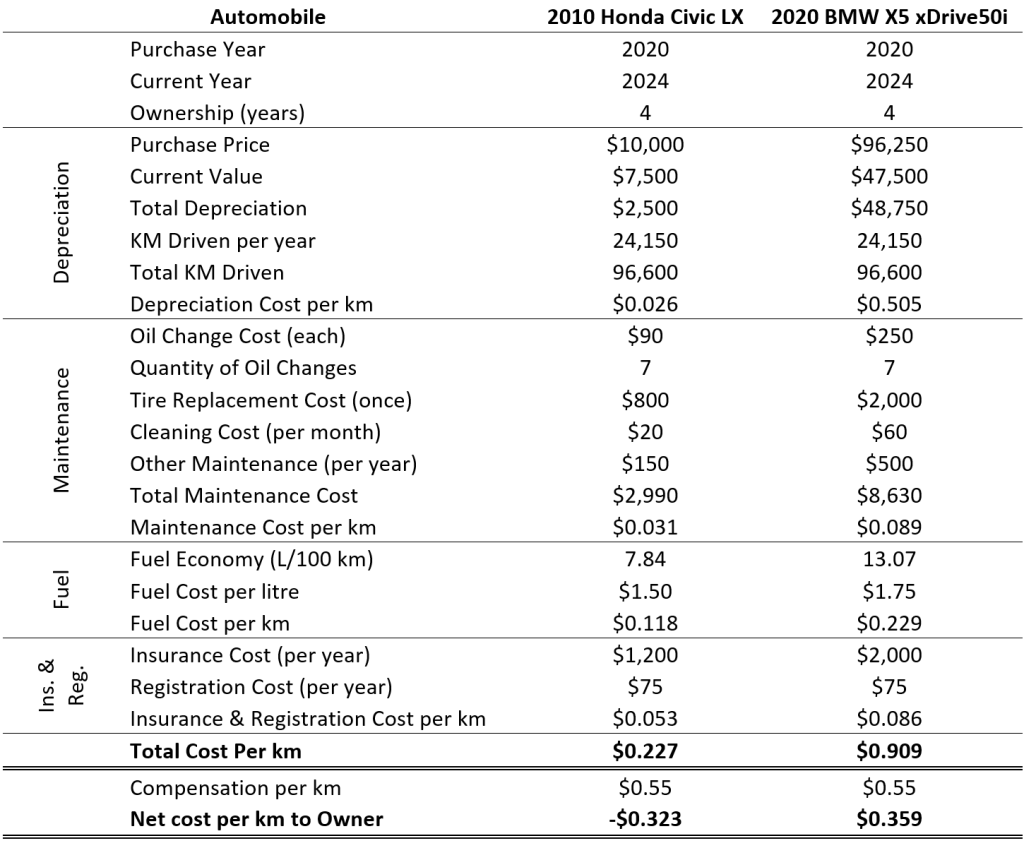

Rather than providing an automobile allowance or a company vehicle, your employer may offer mileage rates where they pay you per mile or kilometer traveled. The CRA (Canada) and IRS (USA) have established mileage rates companies will use for their employees. In Canada, the rate could be CAD $0.55/km and in the US it could be USD $0.68/mile. Depending on the type of automobile being driven, your operating costs may exceed what your employer is paying you. This means that you could be paying out of pocket for the privilege of running errands for your employer! The Table below shows a comparison of the total operating cost per km between a used economy car and a luxury SUV both purchased in 2020 and driven the same number of km for 4 years, assuming no borrowing costs.

If the owners are being paid $0.55/km, the Honda owner is netting $0.32km, while the BMW owner is losing over $0.36 for every km driven for business purposes. The table above shows the breakdown of this. If your employer expects you to drive your personal vehicle for business purposes, you should ensure that your vehicle’s total cost per km is lower than the rate you’re being paid to ensure that driving for your employer’s purposes is not costing you. A single tire blowout or rock chip while driving for company purposes may cause the costs to jump even higher, making it even more important to lower your vehicle’s cost/km. For more information on car ownership costs, see my post of The Cost of Car Ownership.

Leave a comment